Mortgage charges: For these personal finance choices, you incur an application charge of around $20 on mortgage merchandise.

If you want funds for an vehicle repair or other crisis price, there are several options to payday loans in Texas — and They might have substantially decrease interest fees and for a longer time repayment conditions, which could help make the debt more manageable.

Should you be trying to find a private bank loan, your very first question can be how you may get the best terms. Your financial loan’s interest charge and repayment phrases will be largely determined by your credit score score.

The Draw back: Although some similar rent reporting tools offer retroactive reporting, like as many as 24 months of preceding payment heritage, StellarFi doesn’t.

For example, recognizing the scale of installment loans aurora il plus the APR, it is possible to determine exactly how much cash you owe month to month and what is the timeline from the payout.

Achievable is another on the internet lending platform that provides quick-phrase loans with versatile repayment possibilities. Just like Fig Loans, Achievable aims to offer reasonably priced and truthful fiscal alternatives that will help individuals handle their bills.

In combination with these charges would be the APRs that could utilize throughout repayment. What you want to watch out for is usually a lender/mortgage with nominal to zero costs and small APRs. By doing this, you don’t end up spending much more than two times your bank loan principal.

In the following headings, we’ll detail what kinds of loans they're, if you can pick them for negative credit score, as well as the benefits and drawbacks attached to them.

So, the personal loan sum marketed by a lender must tie in with the goal you would like to use it for prior to finding.

Even so, there exists a safer way to get installment loans quebec and repay it using a lesser volume of tension and time wasted.

Credit score builder loans can be found in all styles and sizes. They Every have a singular desire price, call for a different least monthly payment, and fluctuate appreciably in their repayment phrases.

We’ve rounded up our top rated alternatives click here and highlighted the attributes we expect you’ll find most handy. Keep reading to find out if one particular may be appropriate on your problem.

Borrowers (other than current buyers) in these states are subject matter to these highest unsecured personal loan measurements: North Carolina: $7,five hundred. An unsecured personal loan is really a loan which does not require you to provide collateral (for instance a motorcar) towards the lender.

In conclusion, though Fig Loans is actually a trusted on the net lending System, Checking out substitute possibilities can offer you a broader viewpoint and likely superior financial loan phrases. LendUp features a possibility for people with minimal credit score historical past to entry resources though improving upon their credit rating scores as a result of their LendUp ladder. OppLoans provides much larger bank loan quantities with more time repayment conditions and a lot more inexpensive rates as compared to standard payday loans. MoneyKey will allow borrowers to repay their loans in mounted every month installments, offering extra Manage in excess of their funds. Possible Finance focuses on affordability, transparency, and credit score-making opportunities. CashNetUSA gives both equally payday loans and installment loans, catering to people today with different credit score scores.

Daniel Stern Then & Now!

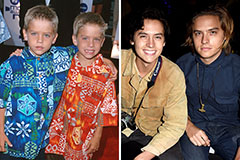

Daniel Stern Then & Now! Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Tatyana Ali Then & Now!

Tatyana Ali Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now!